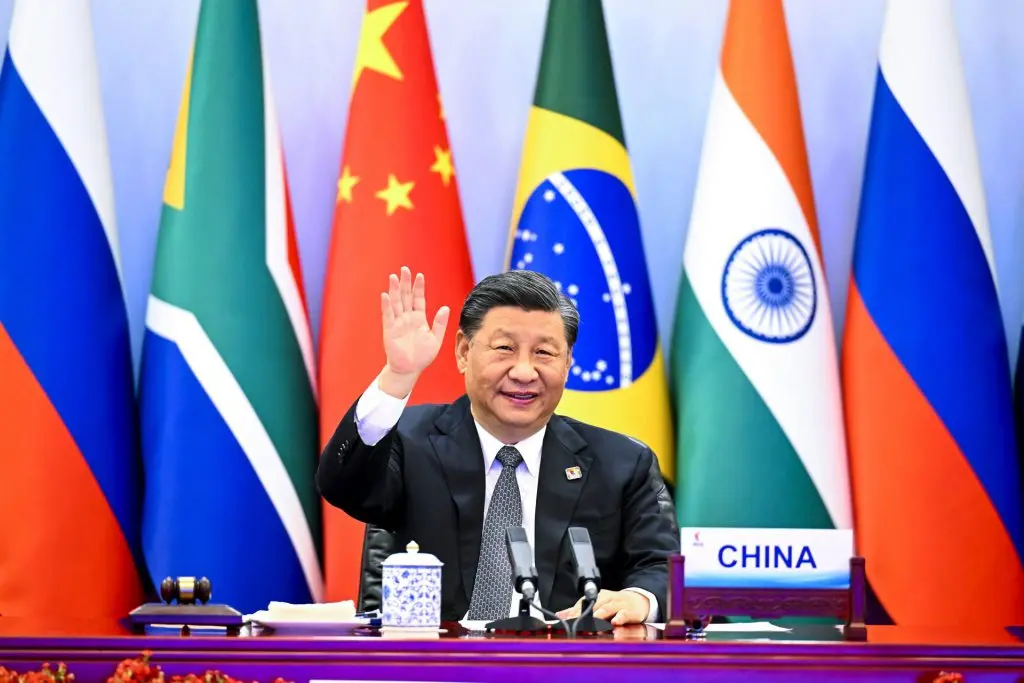

BRICS member China is looking to promote local currency swaps with 29 developing countries worth 4 trillion Yuan, which is equivalent to $553.49 billion. The bilateral currency swaps could facilitate trade and investment options by adding a safety net for all local currencies. For the uninitiated, currency swaps between Central Banks are finance agreements in which one country can exchange its own currency for another. This helps Central Banks save costs in exchange rate risks and keep the option of using their local currencies always open.

Also Read: 3 U.S. Sectors To Be Affected If BRICS Ditches the Dollar

The US dollar will play no role in the swaps as local currencies will remain the centerpiece of all transactions. In other words, Central Banks can trade billions worth in exchanges making their local currencies remain ‘always trading’ in the market. Among the 29 countries, China is also considering to include all BRICS nations in the currency swap agreement.

Also Read: After BRICS, 3 New Countries Ready To Launch Own Currency

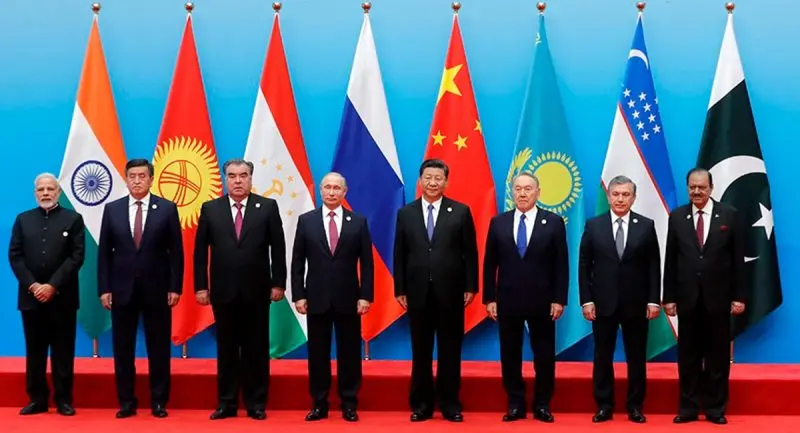

BRICS: Currency Swap With 29 Countries Worth $550 Billion On the Cards

Pan Gongsheng, Governor of the People’s Bank of China said that the currency swaps will be a useful addition for emergency liquidation at times of financial turmoil for BRICS and other developing countries. “Bilateral currency swaps can provide emergency liquidity support in times of turmoil in international financial markets and banking crises in some countries,” he said to Reuters.

Also Read: India Ditches BRICS Countries, Buys More U.S. Oil

BRICS nation China is looking to push Asian countries to sign the agreement as it helps both economies. The constant exchange in the market will keep local currencies remain intact and easily liquidated at the time of need. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

Also Read: BRICS: Russia to Test Digital Ruble For Citizens & Businesses

The currency swap comes at a time when the BRICS alliance is looking to cut ties with the US dollar. “China’s bilateral currency swaps with selected countries also formed an important part of IMF-led international bailout relief package,” Gongsheng added.