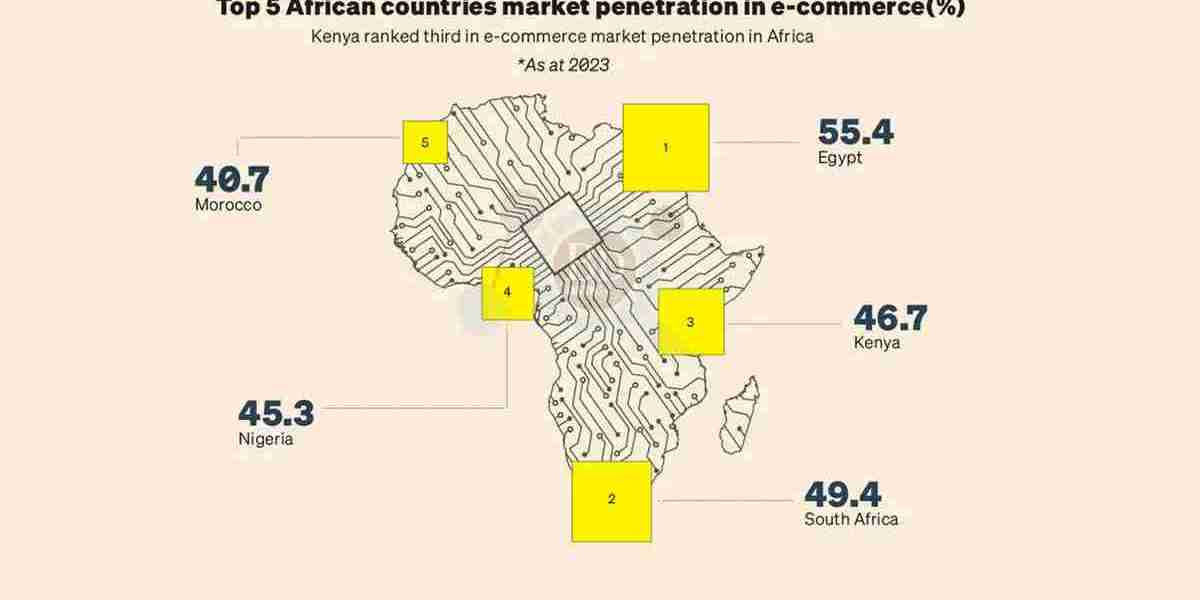

Statista, a German data and business analytics platform, ranked Kenya third in terms of e-commerce market penetration on the continent with 46.7%. This is followed by Egypt, which came top with an e-commerce penetration of 55.4%, and South Africa (49.4%). This represents an improvement over the fourth-fastest-growing e-commerce economy in sub-Saharan Africa, according to a 2020 analysis by the United Nations Conference on Trade and Development.

However, Kenya’s improving rankings come at a time when e-commerce companies continue to report heavy losses that are driving some out of the market. For example, Jumia, which had suffered cumulative losses of $87.8 million (£11.5 billion) by the end of 2021, recently closed its food delivery business in Kenya along with seven other countries in Africa.

Other players, including SkyGarden and OLX, faced several challenges in the market, causing them to close down or find buyers.

In 2020, Statista revealed that e-commerce in Kenya ranks first in terms of digital revenue with a 76.1% share estimated at $1.1 billion. The development of e-commerce is driven by the implementation of the digital economy plan targeting the ICT sector and e-commerce activities.

Moreover, over the years, the percentage of Kenyans over the age of 15 who have mobile money (68.7%) or a bank account (50.6%) has been increasing.

Project | Stanlaus Manthi | Compiled by John Waweru | Sources: Kepios, Statista

It is worth noting that the number of people using the Internet has tripled in a decade, from 7.48 million users in 2014 to 22.7 million in January 2024.

As a result, more Kenyans can now transact online due to the high use of developed mobile payment systems such as M-Pesa.

n Kepios’ recent report, e-commerce revenues were mainly generated by electronics ($366 million), fashion ($280.3 million), toys and hobbies ($45.5 million) and furniture ($32.2 million).

The report also indicated the share of Kenyan internet users involved in e-commerce activities. According to him, 37.6 percent Kenyans buy a product online, followed by people using online price comparison websites (15.7%).

However, certain challenges are hampering the development of e-commerce in Kenya, such as the regulatory framework following the introduction of the Digital Services Tax in 2020.

The lack of good fraud detection and prevention mechanisms in many African countries is hampering development and building trust in the continent’s markets, leading to delays in the implementation of e-commerce.

Therefore, there is a need to reduce technology costs, strengthen cybersecurity, create a favorable regulatory environment and improve logistics to attract more companies to e-commerce.