Several Kenyan banks registered improved profits in the year ended December 2023 despite harsh economic conditions worsened by non-performing loans.

As a result, top banks except Kenya Commercial Bank (KCB) paid out a total of KSh 63.06 billion to shareholders. According to Business Daily, the lenders' cumulative net profits rose from KSh 11.43 billion to KSh 185.9 billion in 2023.

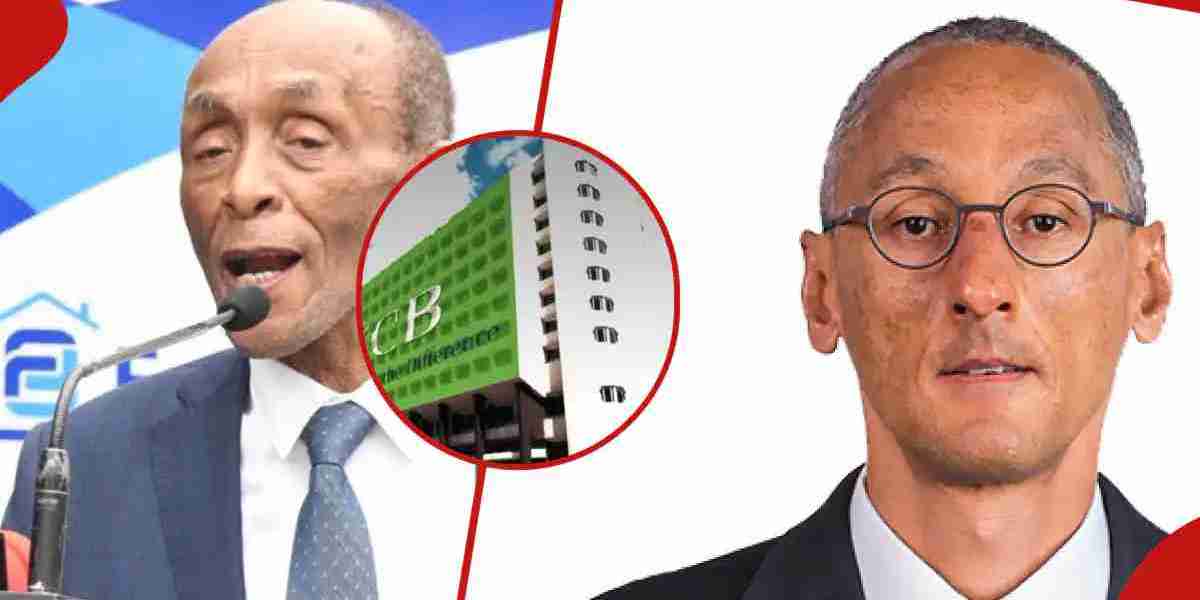

List of top Kenyan banks, their owners 1. Equity Bank The lender proposed a dividend payout of KSh 15.1 billion after recording KSh 43.7 billion profit after tax. According to Forbes, the bank's founder, Peter Munga, owns a 0.4% stake in the lender worth $5 million (KSh 657.5 million) after selling most of his shares.

The bank's chief executive officer (CEO) James Mwangi’s total direct and indirect shareholding is 3.39%.

2. Co-operative Bank Co-operative Bank Kenya shareholders will pocket over KSh 8 billion in dividends for the year ending December 2023. In January, Kenyan billionaire businessman Baloobhai Patel purchased an additional 20.5 million Co-op Bank shares valued at KSh 232 million.

Patel is now the second-largest Co-op Bank individual shareholder behind the lender's CEO, Gideon Muriuki. In the six months to June 2023, Metropol TV reported Muriuki bought 14.6 million shares of the lender valued at KSh173 million.

His stake stands at 2%. Other shareholders, according to the bank's shareholding structure, are Cyrus Kabira Njine 0.12%, Macloud Mukiti Malonza 0.09%, Jacob M Oludhe Ondik 0.09%, Isaac Nehru Otieno Miswa 0.08%, Fredrick Fanuel Odhiambo 0.08%, Julius Kipkurgat Sitienei 0.07%, Waithaka James Gichohi Kiiru 0.07%, Shah Mahendra Kumar Khetshi 0.07%.

3. NCBA Bank Local companies own 76.97% of NCBA Bank, followed by local individuals (22.63%), foreign individuals (0.35%) and foreign companies (0.05%). Philip Ndegwa's family now tops the NCBA Bank Kenya individual shareholders list after buying an additional 31.6 million shares valued at KSh 1 billion.

4. KCB Bank According to Kenya Commercial Bank's shareholder profile, local institutional investors own 45.01% of the lender, followed by local individual investors (26.37%). The National Treasury controls 19.76%, while foreign investors own an 8.86% stake. National Social Security Fund (NSSF) sold 21.63 million shares in 2023, reducing its stake to 8.39%.