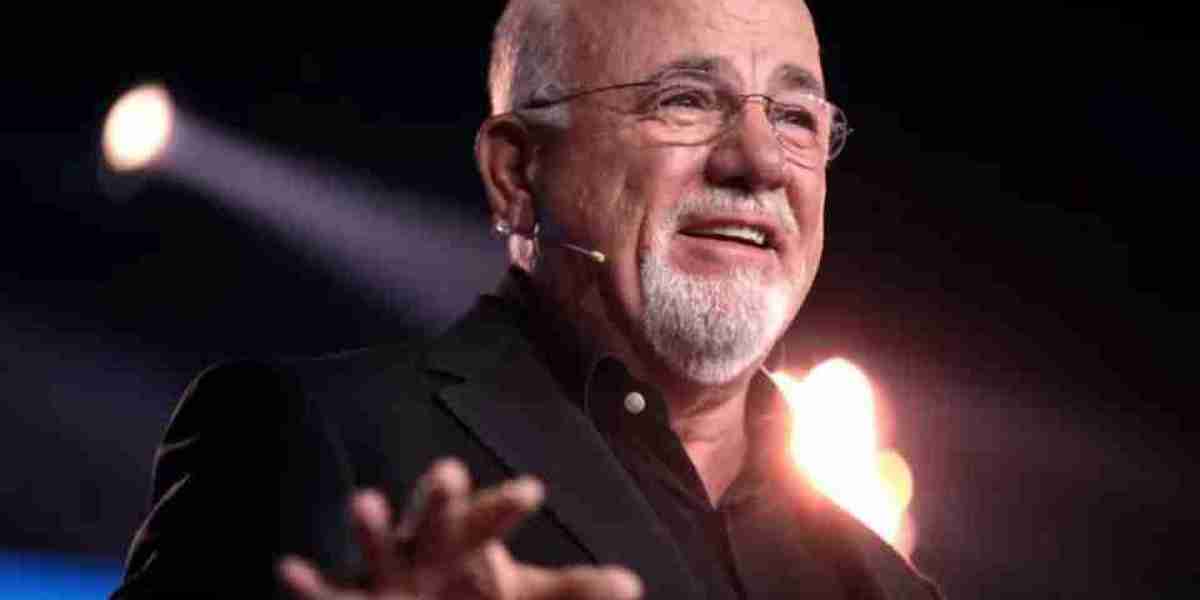

Contrasting his stance with that of radio personality Dave Ramsey, a vocal advocate for a debt-free lifestyle, Kiyosaki’s insights stir a compelling discussion on financial strategies. “WHO IS RIGHT? My friend Dave Ramsey says ‘Live debt free.’ I say ‘I use debt to invest. I am $1.2 billion in debt,‘” Kiyosaki wrote, offering a bold entrance into the dialogue on debt management and financial freedom.

Kiyosaki’s argument unfolds with a reflection on the wisdom behind Ramsey’s advice versus his own. Acknowledging the validity of living debt-free for the majority, he said, “For most people with low financial acumen, Dave's advice is the smarter advice.”

Yet, he counters this by highlighting the potential benefits of debt as an investment tool for those well-versed in financial matters. “For the financially educated and experienced, my advice may be better,” Kiyosaki said, suggesting a tailored approach to financial decision-making based on individual knowledge and experience levels.

This perspective is rooted in Kiyosaki’s financial journey, marked by his substantial $1.2 billion debt — incurred not as a burden, but as a deliberate strategy to invest in assets like gold and silver. Critiquing the conventional approach of saving cash, especially after the U.S. dollar’s decoupling from the gold standard in 1971, he presents his debt as a calculated risk aimed at wealth accumulation.

“If I go bust, the bank goes bust. Not my problem,” he said.